How is Crypto Taxed in the US? Understanding how cryptocurrency is taxed is crucial for anyone navigating the intricate world of crypto. In the US, the IRS classifies crypto as income and capital gains, with tax rates varying based on the nature of the taxable event. Whether dealing with Bitcoin, Ethereum, or altcoins, the IRS […]

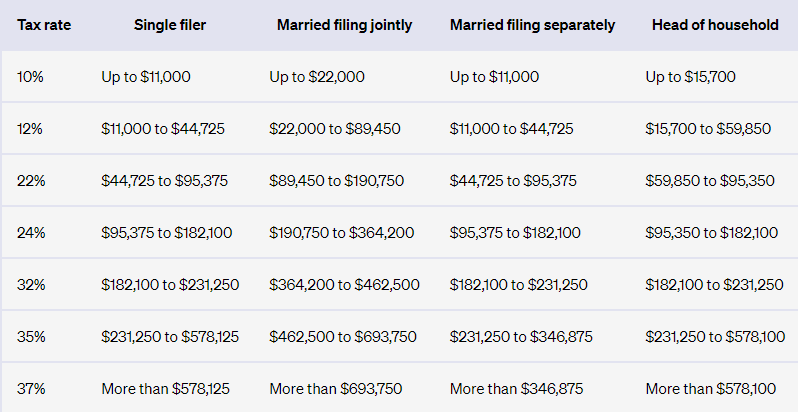

Understanding how cryptocurrency is taxed is crucial for anyone navigating the intricate world of crypto. In the US, the IRS classifies crypto as income and capital gains, with tax rates varying based on the nature of the taxable event. Whether dealing with Bitcoin, Ethereum, or altcoins, the IRS applies the same tax treatment to crypto trades. International users can refer to country-specific guides for additional insights. For US taxpayers, the pivotal factor influencing crypto tax rates is whether the profit comes from short- or long-term holdings. Long-term rates peak at 20%, while short-term gains are taxed at income rates ranging from 10-37%. The exact crypto tax rate hinges on the duration of asset holding and overall income. It spans between 0-37%, covering short- and long-term capital gains tax rates. Activities like mining, staking, lending, or payments for goods are considered ordinary income, taxed at rates corresponding to gross income. While complete tax avoidance during crypto trading is challenging, strategies exist to reduce liabilities. Taxpayers can engage in tax loss harvesting, use specialized crypto tax software, contribute through donations, prioritize long-term gains, and strategically sell in years of reduced income. Earnings from crypto mining, staking, or payments are taxed at ordinary income rates. However, the capital gains tax rate varies based on the duration of asset holding. Long-term trades, held for over a year, enjoy lower tax rates, incentivizing users to adopt a long-term strategy. Hold a digital asset for a year or less, and your gains are short-term, taxed at your ordinary income rate determined by overall income. Hold cryptocurrency for over a year, and your gains fall under the advantageous long-term capital gains rate. Rates also depend on overall income but generally remain lower than short-term rates. Your crypto tax rate in 2023 depends on whether assets were held for short- or long-term gains. Here's a breakdown by income level for US taxpayers: (Tax Rate Table) Explore a range of crypto transactions and their tax implications, focusing on IRS rules. International users can benefit from guides on global crypto taxes. Offset profits from selling any capital asset with crypto losses, up to $3,000 of income. Unused losses can carry forward. Clarification from the IRS states that only losses from federally declared disasters are eligible for deduction through Form 4684. Balance losses from worthless crypto due to bankruptcy against profits, offsetting income up to $3,000. The IRS mandates reporting of all crypto transactions. Any trading, selling, swapping, or disposal constitutes taxable capital gains or losses. Additionally, crypto mining, staking, and yield farming earnings are taxable as income. Effective January 16, 2024, the IRS clarified that businesses in specific digital transactions are not obligated to use Form 8300 until further regulations are issued. This move alleviates concerns about the challenges of applying broad rules to crypto transactions. Navigating crypto taxes is a complex maze, but solutions like TokenTax are here to revolutionize the process. Backed by advanced crypto tax software and a skilled team, TokenTax ensures precise reporting across crypto, DeFi, and NFT transactions. The IRS monitors crypto transactions through exchanges, third-party reports, and blockchain analysis. Assume full transparency, and plan accordingly to stay compliant. Prioritize long-term trades to benefit from lower tax rates. Use specific identification accounting for digital currency to strategically match sales and acquisitions. TokenTax offers flexibility with FIFO, LIFO, HIFO, or Minimization methods for specific ID accounting. Partner with TokenTax to ensure accurate and optimized filing. Explore options like qualified deductions, investing in a tax-deferred 401k, charitable donations, and strategic losses to lower your crypto tax rate. While not obligatory, IRS rules require reporting all crypto transactions, including lossesHow is Crypto Taxed in the US?

What Affects Your Crypto Taxes?

How Much is Crypto Taxed?

Benefiting from Free Crypto Taxes

What is the Crypto Tax Rate?

Short-term Crypto Tax Rate

Long-term Crypto Tax Rate

Crypto Tax Rates for 2023 (Taxes Due in 2024)

2024 Crypto Taxes: What Crypto Transactions are Taxable?

Crypto Taxes for Capital Losses

Crypto Taxes on Lost or Stolen Crypto

Crypto Taxes on Bankruptcies

How to File Your Crypto Taxes

Step-by-Step Filing Process

Understanding Form 8300 for Crypto Transactions Exceeding $10,000

Crypto Tax Software to Simplify Filing

Key Features of TokenTax

How the IRS Tracks Your Crypto Taxes

How Can I Reduce My Crypto Capital Gains Tax?

Choose Your Method with TokenTax

Crypto Tax FAQs

Can I Reduce My Income and Get to a Lower Crypto Tax Bracket?

Do I Have to Report Crypto Losses on My Taxes?